Real World Risk Institute Day 1 - The Black Swan

I just got back home after the first day attending the 5-days workshop held by Nassim N. Taleb on risk modeling in NYC. This is my de-briefing, meant to share a few of my impressions.

Today it has been quite a dense day. Basically a recap of The Black Swan concepts and ideas, still it has allowed for some discussion among the attendees, Nassim Taleb and his fellow teammate, Raphael Douady. Many interesting insights have been developed since the morning sessions, but I am here to report about two specific ones.

The innovator’s dilemma. Reframed.

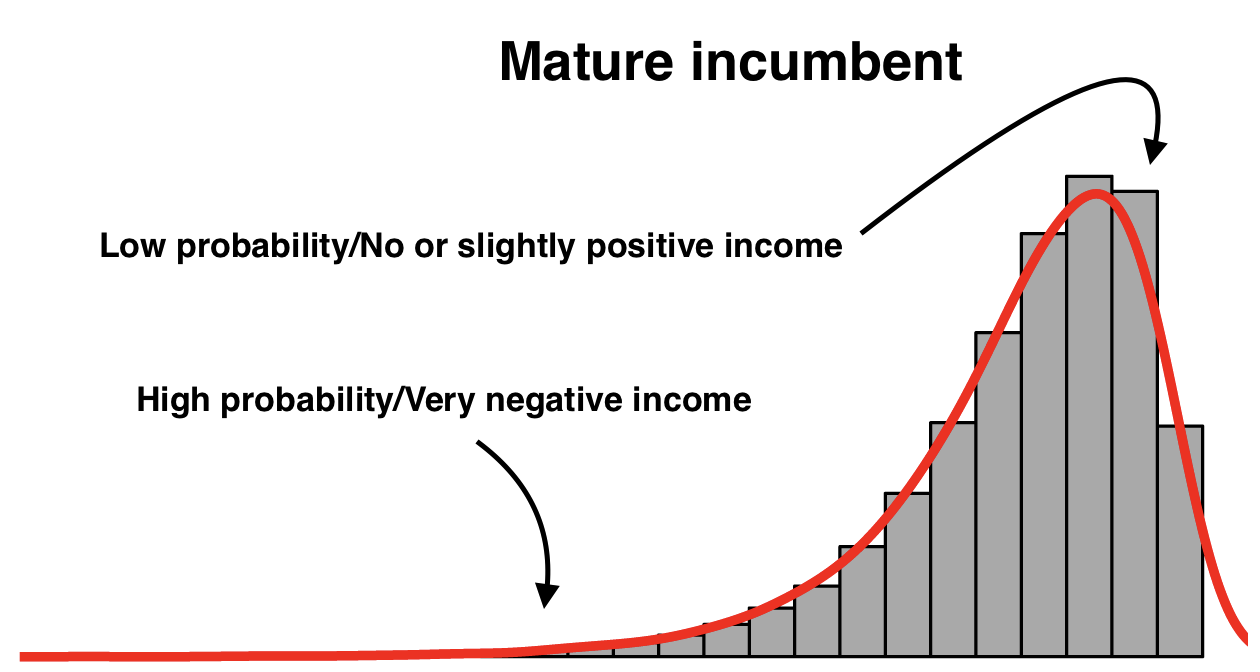

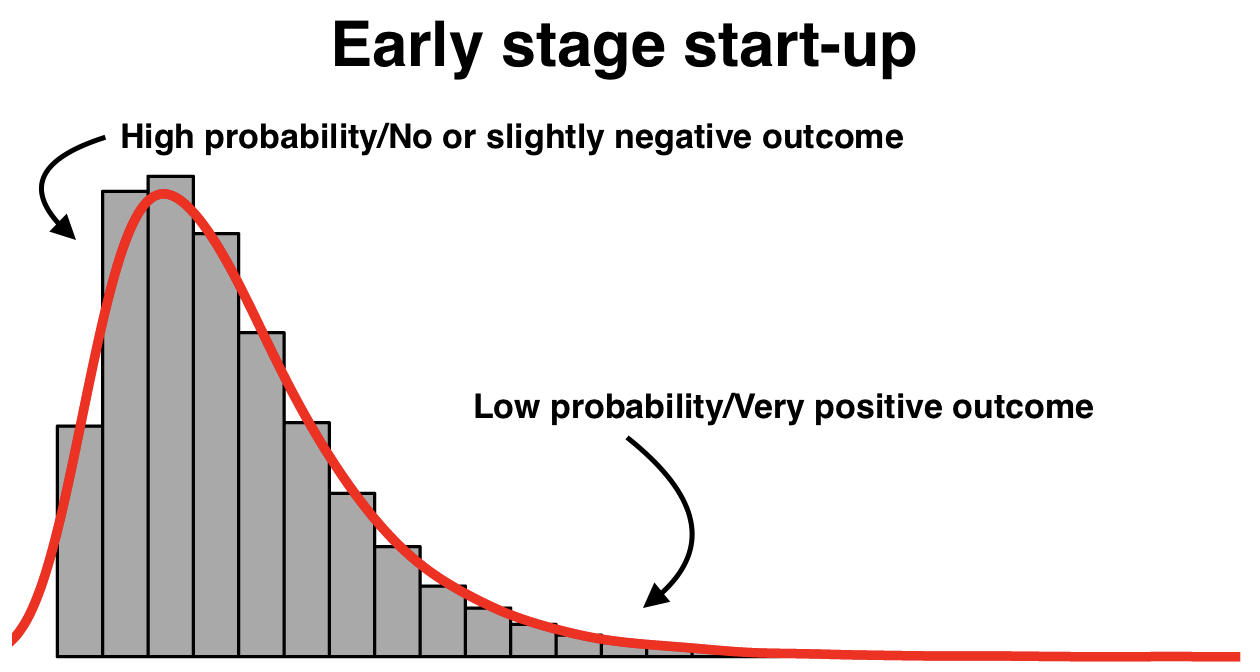

Antifragility is defined in terms of how asymmetrical the exposition of systems is to benefits or damages. If a system is exposed to terminal damages and no significant improvement, it is fragile — think of a porcelain cup or of money in a zero-interests bank account; if a system is exposed to unlikely terminal damages and no significant improvement, it is robust — think of a brick or of the Phoenix, the mythical continuously re-born bird; if a system is exposed to limited damages and open ended improvements, it is antifragile — think of the immune system or a venture capital.

What we observe is that companies are antifragile in their early stages, because they have not invested too much yet, but, as their position in the market becomes more and more dominant and they get more and more to lose, the distribution of probability of their next move becomes fragile.

This concept today, while listening to Taleb, wasn’t sounding new to me and, after some memory-squeezing, all of a sudden I made the right connection: The Innovator’s Dilemma! It is a book written by C. Christensen showing

how successful, outstanding companies can do everything “right” and yet still lose their market leadership — or even fail — as new, unexpected competitors rise and take over the market

When an existing company has an estabilished product, service and/or business model, when a new innovative competitor enters the market, by the time the new product has attracted the incumbent’s customers it is too late for the incumbent to react to the new product. Having reached this point it is too late for the incumbent to keep up with the competitor’s improvement pace, which by then is at its maximum.

An upper bound to economies of scale

Both these considerations about fragility of organisations and the innovator’s dilemma are key constraints to the development of the so-called economies of scale. If growing bigger puts you in an intrinsically dangerous position, is getting bigger and bigger the right way to grow?

Taleb today has been laconic: Economies of scale are a scam.

When virtues collide

The second key insight of the day was when Nassim Taleb asked the audience for the condition required for prudence and courage to be the same. When do courage and prudence become the same thing?

All of a sudden my mind focused back to an old reading, dated 2004, on a book titled Extreme Programming Explained — 2nd Edition, still one of the best books on computer programming I have ever read. Its author, in one of a million other sparks of nerd wiseness, defines courage as the constant and relentless removal of elements of danger that we may encounter on our path as opposed to any other reckless attitude that we may associate to this word.

This means for example to prudently write automated tests for our software, in order to have the courage needed to refactor our codebase: this can mean prudently having regular team retrospectives, in order to have the courage of openly addressing issues; it can mean supporting courage in experimenting new contracts with a prudent selection of the customer to involve; and so on.

When this definition by Kent Beck popped up in my mind I had no doubt anymore. I gave Taleb my answer: “Courage and prudence are the same thing when you act in a way that allows you to develop and show courage”.

It was the right answer.

The sensation

Overall it was a good starting day. Taleb is an engaging speaker and kept our attention alive throughout the whole day, despite the very traditional frontal slide-based format of the training — this being probably the only flaw so far.

In a day which proved to be a perfect reminder of the fundamentals we recapped, we’ve got our chances to connect a few more dots and enjoy Taleb’s histrionic satire:

Read the second part of Jacopo's journey: "Real World Risk Institute Day 2".

Check out the full list of our upcoming training courses: Avanscoperta Workshops.